As soon as you enter the offices of Menno S. Martin Contractor Limited, you will notice it is a comfortable place. That was my first impression, the first time I visited.

As you get to know the people at Menno S. Martin you will learn about the fabric of their business, as woven by their founder 70 years ago. The fabric consists of: forethought, fair deals, hard work, mastery, loyalty…and stories.

Founder Menno S. Martin is remembered with fondness. The fabric of Menno’s values, his character, and his business lives on. His sayings and stories are retold with fondness and admiration. Menno S. Martin created a business where people want to work. Several people have worked there for over 25 years.

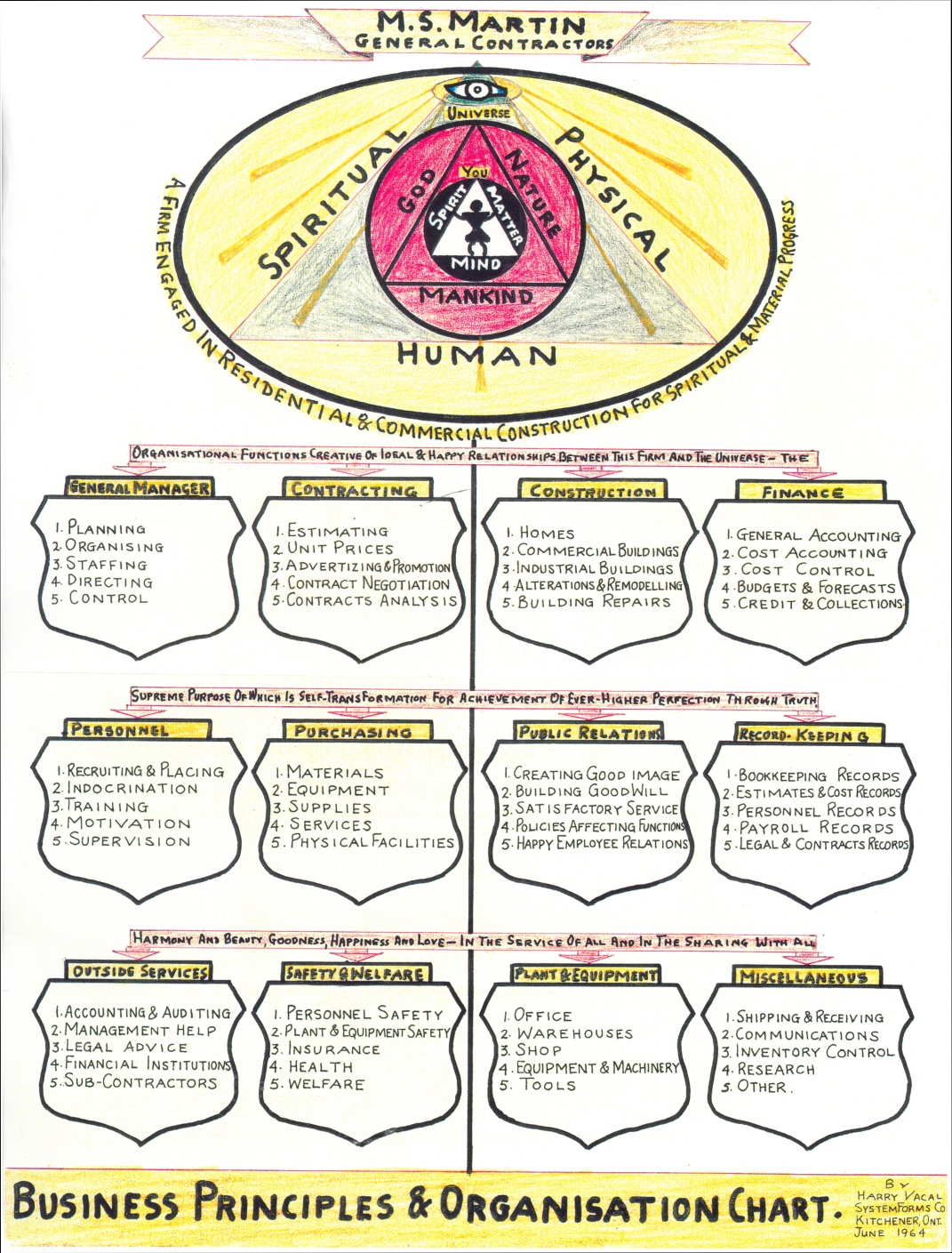

Here is a Menno S. Martin picture that is worth much more than a thousand words.

I was touched and impressed when Laverne Brubacher gave a copy of this picture to me. I was touched because this document from the early days of the company is clearly a special gift. The original and copies are proudly displayed in the offices at Menno S. Martin. I was impressed because this picture illustrates the best of strategic planning: a single page, chock full of Vision, Mission, Values...and communication.

Clearly, Menno S. Martin practiced principle-based leadership. Quoting Laverne, “Three things were important to Menno: his faith, his family, and his business – in that order”. The above picture illustrates that and it links everyone at Menno S. Martin to the founder they honour.

Menno S. Martin passed in 2005. His legacy of work and leadership lives on.

“Family is first.”

That quote captures a big part of Menno’s wisdom and legacy. It applies to the people who work at the company. It applies to the people who do business with them. The people at Menno S. Martin incorporate ‘family is first’ when they do projects for their clients. If you check out the testimonials at the company website then you will see ‘family is first’.

Loyalty – that’s a word both Laverne Brubacher and Art Janzen used several times when they spoke about their business.

Laverne joined Menno S. Martin on his 21st birthday in 1965. Menno trusted Laverne enough to offer him shares of the company in 1968. The trust and loyalty between these two men remained solid throughout the rest of the time they worked together. Laverne took over from Menno in 1976 and Menno retired in the early ‘80s. However, Menno was a regular visitor at the offices long after he retired.

Laverne and Menno had a very special relationship. The men shared values: forethought, fair deals, hard work, mastery, and loyalty. In addition, Laverne was a willing student of business and Menno was a willing teacher of business.

This mentoring of business know-how is a key facet of Menno S. Martin’s success story.

Laverne talks about Menno, “Menno had a built in sense of business ethics. Honesty, care, loyalty, trust – all came naturally to him. He was an entrepreneur – and he seemed to come by that naturally. His quiet enthusiasm was contagious.”

And, Laverne has shared his education with another generation of Menno S. Martin leaders, Art Janzen and Trent Bauman. He shared the key lesson - 'treat your people well and they will be loyal'.

In anticipation of his retirement, Laverne led a thorough transition planning and implementation exercise, which included selling his shares to Art and Trent...over a comfortable period of time. Now, Laverne has eased out of his operating role and Art and Trent run the business.

And now, like Menno before him, Laverne stills shares his time and expertise, at the office, with the fellows he mentored.

Laverne, Art, and Trent have kept alive the legacy of Menno S. Martin’s business leadership - covering the important things like Vision, Mission, and Values. To these things each of them has added a personal touch…personal talents and strengths.

This allowed smooth transition to a new generation of owner-leaders.

From Menno

To Laverne

To Trent and Art

Smooth transition of ownership – well, that’s good for all involved: it is good for families, owners, employees, clients, allies, and community.

That’s the Menno S. Martin legacy.

A Family Business - Well Done!