|

|

by Rick Baker

On Dec 4, 2013

There are many different ways to structure arrangements tied to succession planning and selling ownership shares. When selling ownership shares as part of your planned succession process, five key considerations must be covered:

- Your needs.

- The needs of your fellow shareholders.

- The needs of your key employees.

- The best interest of the corporation – i.e., the sum of #1, #2, & #3 above [and other stakeholders, including clients, suppliers, and allies].

- The buyer’s needs.

Most people who complete a succession plan are surprised by the amount of work required and the amount of time it takes to address all of these five considerations. Most people are surprised because they failed to invest time thinking in advance. Instead of thinking and planning in advance most people back into succession activities because some crisis has caused them to have to back into the change.

The better approach: spend time up-front considering the above five things. And, invest time regularly – say, one day every year – considering the above five things. This will ensure they have been covered when the time for succession action arrives. Also, this will remove many problems both at the time of succession and prior to that time. The commitment to invest time regularly to consider the above five things is a commitment to strategic planning and a commitment to understanding the people you rely on for your business success. That is time well invested.

You and other stakeholders will have personal needs: self-actualization, creating things of value, etc. We will not delve into those needs here. Here, we will be addressing your money needs and specifically how to best ensure those needs are met…how to maximize the likelihood there will be no surprises…how to provide flexibility.

Share Purchase & Sales Agreements: Main Considerations

The Share Purchase & Sale Agreement will be designed to confirm the rights and obligations of the seller [or sellers] and the buyer [or buyers]. Those rights and obligations will address four main considerations:

- Interests: the seller’s interests and the buyer’s interests

- Money: in most agreements, most of the seller’s and buyer’s interests are tied to money

- Risks: both parties are concerned about covering risks to the extent possible and practical

- Timing: the rights and obligations covering interests, money, and risks will have set time deadlines and limits

NOTE: To a large degree, the seller’s interests and the buyer’s interests are opposed. The seller wants a high price; the buyer wants a low price. The seller wants to transfer as much risk to the buyer as possible; the buyer wants to assume as little risk as possible. Timing desires also differ.

Links to articles about ‘People’s Interests’… Link1 Link2 Link3

The Way to Negotiate:

- Recognize interests will often be opposed

- Focus on fully understanding your interests and the buyer’s interests…observe carefully, listen well, think before judging

- Think constantly about ‘options’…rather than saying “No” to the buyer’s interests/requests say “Let’s see if we can come up with a middle-ground solution” [Seek alternative ways of covering issues…think about ‘Options’]

- Seek shared interests, paying close attention to whether or not the buyer actually wants to complete the purchase [i.e., Is the buyer’s appetite to purchase as least as strong as your appetite to sell?]

- Complete agreement on small, easy-to-get-done pieces…build momentum into the process

- Pay attention to the pace of the negotiations…ideally, momentum builds and sustains

- Working with the buyer directly, complete agreement on the ‘commercial terms’ before taking the deal to your lawyer for formal papering

A Sampling of Options [options in the general sense and Options in the investor sense]

Escrow: Shares and money can be held by a trusted 3rd party. Often, that third party is a legal firm that holds the asset in escrow. Here’s an example of how escrow can provide middle ground: Say the buyer cannot afford full payment on the day the deal is to close. This exposes the seller to risk – Will I receive the remainder of the payment? In reaction to the risk, the seller usually does not want to deliver all the purchased shares to the buyer. Possession of the shares has legal implications…maybe possession is 90% of the law…even if it isn’t 90%, possession of shares is important. So, the seller wants to hold back shares until full payment for them is received from the buyer. On the other hand, this exposes the buyer to risk - How do I know I will receive those shares? One solution is to place the shares under control of a trusted 3rd party…a legal firm. One way to accomplish this is to create an Escrow Agreement. It contains the details of what needs to happen [payment buy buyer] in order to release the shares [to the buyer]. The buyer, the seller, and the legal firm sign the Escrow Agreement.

Puts & Calls: People – known in law as a Person – can own shares of a corporation. The corporation can also own some of its shares: when the corporation owns the shares they are called Treasury Shares [or Treasury Stock]. When you boil it down, a person owns shares for one reason; a Person owns shares because he or she thinks the shares will be worth more money in the future than their current cash-in value. While the person thinks that the shares will be worth more in the future, the person also knows there is risk…the shares could be worth less in the future. To protect against the downside the owner of the share can buy an Option known as a Put. The Put provides the owner the right to sell the share back to the corporation at a known price. Conversely, people who want to have the right to buy a share at a known price can buy it today at the market price or they can buy an Option to Call the share in the future at a known price. These financial derivatives build optionality and stability into the financial markets.

Privately held companies do not have the liquidity enjoyed by larger publicly-traded corporation shares. In layman’s terms – there are few buyers and few sellers of private company shares. So, in the private sector Puts and Calls are arrangements between few sellers [often only one] and few buyers [again, often only one]. Regardless, private-business puts and calls provide options and routes to middle-ground during negotiations. Here’s an example of how a put & call combination can provide middle ground: Say the seller maintains a minority shareholder position after selling shares to the buyer. There will be few buyers for the shares held by the seller, who is now a minority shareholder. So, a put option can provide the seller comfort – for example, the seller has the right to put his or her shares to the company for $100,000. At the same time, the buyer may want the right to remove the minority shareholder. This can be accomplished by providing the buyer the right to call [from the monitory owner] the share. For example – the buyer has the right to call the minority owner’s shares for $200,000. This places value range on the shares, $100,000 to $200,000. The seller would gladly accept $200,000 for the shares…but the buyer is not prepared to pay that price today…maybe in the future, but not today. The buyer would gladly pay $100,000 today…but the seller is not prepared to sell at that price today…maybe in the future, but not today. So, the put & call arrangement limits the risk for both parties while, at the same time, it provides both parties the ability to separate company at a defined price [if one party, in the future, wants to part company].

Vendor Take Back: Often, buyers do not have the money to make full payment for the shares. Rather than lose the deal because of lack of buyer-money, the seller can allow the buyer to defer some of the payment. In simple terms, the seller is loaning the buyer money. Usually, the buyer signs a promissory note, agreeing to pay a defined amount at a defined time deadline. To reduce the seller’s risk, these payments can be made in instalments. When this happens the buyer signs a series of promissory notes, each having a different time deadline for payment.

Creativity

Sellers and buyers must obey the law. That’s fair play. And, that’s the only boundary. Within that boundary sellers and buyers can get very creative…working to satisfy their individual interests and their shared interest to get a deal done.

Sellers and buyers need the help of professionals to get the deal done: at least, lawyers and accountants. Lawyers and accountants who deal with corporation law and small businesses see some amazingly bad things throughout their careers. They have witnessed a string of business people who lie, cheat, and steal from one another. They have seen failure to fulfil commitments, bounced cheques, employee sabotage, tax evasion, espionage, patent infringement, and a long list of other things that happen on the bad side of business. A career full of the bad side of business can sour a person. You will want to make sure that soured person is not the person you hire to help you create and close a Share Sale and Purchase Agreement.

Choose your allies carefully. And, work to build a relationship with the person who is buying your shares. Work to understand that person’s interests, desires, and needs. Work to find middle ground that satisfies your needs and the buyer’s needs. Obtain counsel from your professional allies, starting sooner rather than later. When it comes to working out the deal - work directly with the buyer to complete agreement on the major commercial terms before calling in your professional allies to finalize the details. Know what you are doing, plan each step, and oversee the entire process.

The sale of your business is too important to leave in the hands of 3rd parties.

3rd parties will not have your creative capability. 3rd parties will not have your vested interest in getting a deal done, maximizing your money [within reasonable bounds], and minimizing your risks [within reasonable bounds]. Stated another way – 3rd parties often tend to get entrenched while you are solution-oriented. Solution-orientation: that’s how you started the business, that’s how you ran the business, and that’s the best way to exit your business.

69494db3-6c60-4b75-8fd3-29a28010527d|0|.0

Tags:

Succession

by Rick Baker

On Dec 2, 2013

A business owner drives business value by understanding self and understanding others, exercising self-control and influencing others to do the same, focusing on talents and strengths, planning the work and working the plan, making errors and learning from those errors, achieving small successes and converting them into larger successes, communicating in magnetic ways, and by continuously driving to deliver value to other people.

Understanding self and understanding others is important because it is the ‘grounding’ that helps the business owner gain other people’s respect and allows the owner to have self-motivated followers. We cannot motivate other people. However, we can demotivate other people. People who do not understand self and understand others inevitably, through ignorance, do things that demotivate other people. There is much more to be gained, however, reducing the likelihood of demotivating other people is, alone, a sufficient reason to understanding self and others.

Exercising self-control and influencing others to do the same is important because people react poorly to people who illustrate a lack of self-control. Sometimes, people are frustrated and demotivated by others’ lack of self-control. Other times, they are annoyed and angered. Either way, flight or fight, people do not do what bosses want them to do when bosses show them a lack of self-control. A business owner will not be able to influence behaviour in a constructive way if he or she lacks self-control.

Focusing on talents and strengths is important because everyone has talents and strengths and everyone has lack of talent and weakness in other areas. The greater the talents and strengths in one area the greater the lack of talent and weakness in other areas. Business owners succeed when they obtain the help of talented, strong performers. They have greater success when they put energy to best use by allowing people to unleash performance with their strengths. They have even greater success when they don’t waste energy forcing people to perform against their weaknesses.

Planning the work and working the plan is important because it allows the business owner to illustrate cause and effect. Repeated cycles of cause-and-effect confirm the repeatability of the work done at the business. The greater the repeatability the greater the value in the business. Also, the greater the repeatability the greater the scalability…the simpler the training…etc. One Hit Wonders do not have much resale value. Businesses that can illustrate a successful, sustained track record do.

Making errors and learning from those errors is important because (1) making errors proves you are innovative and (2) learning from your errors proves you are open-minded and change-tolerant. School of Hard Knocks education is of great value. Innovation is fundamental to surviving and thriving. Adaptation is the route to sustainability.

Achieving small successes and converting them into larger successes is important because it proves an understanding of leverage and the ability to take advantage of leverage. At Spirited Leaders, we have a philosophy – task-multiing is better than multi-tasking. Task-multiing is all about leverage, scalability, institutionalizing, efficiency and effectiveness…all excellent value-injection processes.

Communicating in magnetic ways is important because poor communication wastes and negates energy by distracting people from the business’s goals while magnetic communication injects a booster shot of energy and solidifies self-motivation. Magnetic communication engages and empowers. Magnetic communication is simple, clear, and laced with energy and enthusiasm…forward-driving enthusiasm. Magnetic communication is the key to the right business culture.

Continuously driving to deliver value to other people is important because it energizes people by providing quality shareholder experiences, quality employment experiences, quality purchasing and payment experiences, quality sales and collection experiences and all of these quality experiences are taken home to families at the end of the workday. Quality experiences spread. Quality experiences are contagious.

All of these things build value into business. The value exists in the people who perform the work and in the processes that help people perform the work.

by Rick Baker

On Nov 29, 2013

Some day you and your business will part company. Based on our Spirited Leaders’ experience, it appears about 2/3 of small-business owners do not realize some day they and their business will part company. While that sounds absurd, it is a reality in the small-business sector.

So, it is worth repeating: some day you and your business will part company.

Warning: harsh news to follow.

When you and your business part company you may not be aware of it…you may have succumbed to some illness and your business is no longer a priority in your mind. That happens from time to time…especially when the owner of the small business has avoided succession planning for 60 or more years.

That of course, does not have to happen. Some people experience an alternative exit…they decide why, when, and how they will exit and they create plans and perform actions that cause a smooth exit. This smooth exit involves a realization of the value embedded in their business. Money is transferred from the business bank to the owner`s personal bank…or to some other vehicle designed to minimize taxes, maximize usable money, and satisfy the needs of people.

The value embedded in the business is realized and money is transferred to the owner when the owner sells some or all of his or her ownership shares.

Beyond the money, there are many reasons why an owner may want to sell some or all of his or her ownership shares. And, there are many ways to accomplish the sale of ownership.

Two considerations to keep in mind as you grow the value in your business are WHY? and HOW?

WHY?

Why would an owner sell some or all of his or her ownership shares?

Here is a sampling of reasons why an owner might sell some or all ownership shares…

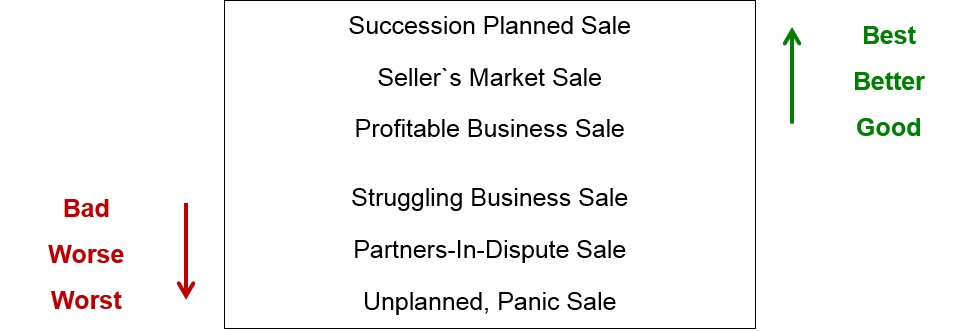

The key message is: there are good reasons to sell ownership and there are bad reasons. Here, good means higher selling price while bad means lower selling price. Higher selling price means higher return on time and effort invested; lower selling price means lower return on time and effort invested.

Of course, the amount of money received by the owner who sells shares is not the only consideration.

The other major considerations can be summed up in four words – the impact on people. This includes the impact the sale of shares will have on:

- you, the seller…is the seller comfortable and will that comfort last?

- your family…is your family comfortable and will that comfort last?

- the buyer…is the buyer comfortable and will that comfort last?

- your fellow shareholders…are they comfortable and will that comfort last?

- your employees…are they comfortable and will that comfort last?

- your clients…are they comfortable and will that comfort last?

- your suppliers…are they comfortable and will that comfort last?

- your community…are the people in the community comfortable and will that comfort last?

For many of these people, comfort will be tied to money considerations…not just direct money but indirect money. Comfort will be tied to a range of indirect-money considerations like, Will I keep my job? Comfort will be tied to interpersonal relationship issues like, What will this place be like when the new owner injects his or her ideas? Numerous other considerations will be in the minds of the stakeholders affected by the sale of ownership:

- How will the new owner change the business?

- When the new ownership is in place, will policies change?

- Will payments to suppliers be affected?

- Will product quality suffer?

- Will the new owner close the place down and move production to the U.S.?

- Why wasn`t I given the chance to buy those shares?

Most people tend to worry when change happens. Some of these worries are beyond the control of the person who is selling ownership shares. On the other hand, some of these worries can be alleviated if the person selling the shares wishes to do that. Succession planning and communication provide the opportunity to maximize people`s comfort levels.

Succession planning and communication: the processes that maximize both money for the person selling ownership shares and people`s comfort levels. That would be the Ideal Scenario.

The Ideal Scenario:

- the person selling the ownership shares receives maximum money

- the person selling the ownership shares is comfortable

- the person buying the ownership shares feels the money spent is a good investment

- the business continues delivering value to all stakeholders

- all stakeholders are comfortable with the change and future prospects

As you create your succession plan, consider these things and assess how important each is to you. Consider your needs to be the highest priority: ensure your money needs are satisfied and ensure you are comfortable with the changes that will follow. Consider the needs of others.

Perhaps, you will rank other people`s needs in the following order:

- the needs of your family

- the needs of your fellow shareholders or partners

- the needs of the buyer

- the needs of your employees

- the needs of your clients and suppliers

- the needs of the people in your community

Perhaps, you will choose to plan ways to satisfy your needs and all of those other people`s needs. That would be the Ideal Scenario.

HOW?

How would you do that?

How would you satisfy all those needs? It will take time and much thought to figure out the best answers. The right approach is to start by considering your needs. One of those needs is maximizing the amount of money you receive when you sell ownership shares.

How do you do that?

In summary, you maximize the amount of money you receive by:

- Creating a plan to build value in your business

- Executing that plan, creating a track record of success….this means: having the right people in the right roles doing the right things and having top-notch processes to ensure scalability and transfer

- Creating a succession plan and working it so: people on your team know what success feels like, people on your team are groomed and able to take on increased responsibilities, and you are replaceable

- Nurturing buyers

- Knowing the value of your business

- Knowing the minimum price you will accept

- Being prepared and ready to sell when buyers want to buy

To whom might you sell your ownership shares?

Let`s assume you want to exit the business and sell all of your ownership shares. You might sell your ownership shares to:

- A financial buyer – a person who views your business as a good stand-alone investment

- A strategic buyer – a person who wants to gain advantage by meshing certain aspects of your business with other investments

- A family member who has been groomed to succeed you

- A family trust or holding company

- A fellow shareholder or business partner

- One or more of your employees

- A local competitor

- The public...i.e., go public by making a public offering

- Other creative options

Or, you might sell the assets in your business and shut the business down.

While it is natural to want to keep your options open, to maximize the money you receive when you exit you will need to reduce the above list to 2 or 3 possibilities. This is essential because – to maximize the proceeds from the sale you will want to strategize then take actions and the best strategies and best actions will differ depending on the target buyer. Some of the options will not apply – for example, if you do not have a family business then you can take the family-business options off the list. On the other hand, if you do have a family business then you must give the family-business options your best thoughts…before you decide to remove them from the list or decide to keep them on the list.

by Rick Baker

On Nov 28, 2013

Yes – there are many other reasons why you are driven to be in business. Regardless, you are in business to generate money. You have set a plan for your business and those plans include the generation of money to cover costs, which will include your personal remuneration.

When all of the costs are covered there will be profit…you have planned for gross profit. Linked to that profit, you likely have planned to make bonus payments to employees, including yourself and to other owner-operators, if any. After those payments are made, the remaining profit can either be left in your business as retained earnings or it can be paid out as dividends to owners.

There are lots of choices in business.

And, business is about generating profits and personal wealth.

Don't be shy about that.

Profit is a valuable thing in business.

Be clear about that.

Talk about profit.

Talk about profit and its relationship with your other corporate Values.

Use visual tools to clarify the picture as you see it.

For example...

In summary, you have 3 ways to receive money from your business:

- Salary [wages],

- Bonus, and

- Dividends.

Many might view the following question as rhetorical.

Nonetheless, we will ask it:

Why would you want to receive money from your business?

The answer is: (1) to cover your current needs for money and (2) to cover your future needs for money.

Few small-business owners will argue with both those reasons.

Fewer small-business owners will do both of them.

Most small-business owners are challenged to succeed at the first one. In fact, succeeding at the first one consumes so much time and energy, most small-business owners never get around to working on the second one.

Why?

Because most small-business owners fail to plan. When they fail to business plan they pave the path for failing to succession plan. Time spent planning and particularly time spent succession planning keeps the end-point vision front and centre in the business owner’s mind. That vision is linked to longer-term goals. So, longer-term goals are also front and centre in the business owner’s mind. When the end-point vision and long-term goals are front and centre, actions have guiding lights to follow. With guiding lights in place, the likelihood of success increases.

This is another key reason you should create a succession plan.

Separate yourself from the pack.

About the pack: Most small-business owners will be acutely aware of the need for current transfers of money from their business bank to their personal bank. They are acutely aware of the need because they know they need personal money to buy food, pay for a place to live, pay for a car…and pay for a long list of other things. Most small-business owners will expend a great deal of energy figuring out how to make these money transfers to cover their immediate, personal-money needs.

Yet, most small-business owners will expend little or no energy figuring out how to make money transfers to cover future needs. As a result, most small-business owners are ill-prepared to cover personal-emergency cash needs and even more fail to prepare for their retirement-money needs.

Increasing the likelihood of business success…that is one of the main reasons a business owner must perform succession planning. As Napoleon Hill taught in his 1937 classic ‘Think And Grow Rich’ –

“Plan Your Work and Work Your Plan.”

by Rick Baker

On Nov 27, 2013

Covering personal-money needs: that’s an iterative process. Do not expect perfection and do not waste time on details. In reality, none of us can forecast the future. The best we can do is make some estimates, make some predictions, and use them as guides. Recognizing this, covering personal-money needs is an iterative process. As with any planning process, the end results improve with review & adjustment…practice takes the plan closer to perfection.

So, the best time to begin the succession planning process is – Now.

Succession Planning: the recommended approach –

1. Make a ball-park estimate of when you will exit the working world.

2. Make a ball-park estimate of how much money you will need when you exit the working world.

3. Figure out how your current small-business fits into your career plan:

· you may intend to keep your business until you retire?

· you may want to exit your business soon?

· you may see your current business as a stepping stone?

4. Figure out when you plan to exit your current business.

5. Figure out how much personal money you want to extract from your business between now and then.

6. Figure out how much personal money you want to extract from your business after you exit it.

7. Figure out when that money will be delivered from your business bank to your personal bank.

ce76bac5-8b6b-40d2-943f-821b7e5de07e|0|.0

Tags:

Succession

by Rick Baker

On Nov 25, 2013

Regardless of what you are trying to build in your business, you will need the effort and results of other people.

If you mention that to business people, they will say – “That’s obvious!”

If you put on your succession planning eyeglasses and watch those same business people, you will observe – What’s obvious is regularly forgotten.

If you study business people who have been in business for 30 or 40 or more years, you will confirm – If they build a succession planning team at all then they do it at the last possible minute. Most people put off working on succession planning. Even more people put off developing the team they need for succession planning until they are pressed into doing it. Often they are pressed by a personal health crisis or a surprise departure of a partner or key employee.

Failure to spend up-front time building a succession plan that incorporates other people ensures two problems:

1. When the succession plan is built it will be built under stress, maybe even duress.

2. The resulting value received from the business, if any, will be minimized.

Put another way…

If you want to keep the value of your business low and subject yourself or your successor to a whole bunch of stress then make sure you do no succession planning until the last possible minute. For example:

· wait until you are in the ambulance, with people bending over you with IVs and heart monitors, or

· wait until you are 70 or so years old and your heir-apparent – your 40-something son or daughter – says, “Dad, I have waited as long as I could. I have decided to take a job down the street.”, or

· wait until your competitors bury your long-standing business by recruiting your top 5 people.

…and, it almost goes without saying…never, ever discuss succession planning or your money needs with:

· your family members, or

· your business partners, or

· an accountant, or

· a lawyer, or

· a wealth advisor.

On the other hand…

If you want to maximize the value of your business and maximize the comfort and contribution of your key people then make a habit of treating succession as an ongoing investment in your business. Identify the people who could be vital within your business and who could help you accomplish you vision and goals. Understand their needs and aspirations and learn how those needs and aspirations can be satisfied as you accomplish your vision and goals. Work to obtain the buy-in of key people and inspire their long-term performance. Work continuously at delivering value to these key people in exchange for their expertise. Work to help them accomplish their dreams.

Nurture and develop a successor for your business. Mentor this person. Partner with this person. Make sure this person knows he or she is your most-trusted business ally. Make sure this person wants to be in that role. Do not assume…talk openly and regularly about succession…talk openly and regularly about needs and aspirations, both yours and theirs.

Also, identify unbiased 3rd-party experts who will support your business over the long-term. Build, over time, relationships with those experts. Work to understand their advice. And ensure your interactions with them satisfy their business needs and aspirations.

Ensure your business succession planning aligns with your personal family-needs. Ideally, you will have the full support of a significant other. While this is beyond the scope of this Thought Post, the fact is – very few people achieve material business success without the support of a significant other. Failure to meet the needs of a significant other can have major negative implications on your business. Of course, this can be particularly true if you are involved in a family business. However, the negative impact marital disputes can have on a business is not isolated to family businesses or family. For example, your business and your business partners can be named in legal battles that follow marital disputes.

Regardless of what you are trying to build in your business, you will need the effort and results of other people.

Remember that piece of obvious advice.

And, remember that applies on many fronts. While this is not intended to be a complete or comprehensive list, remember that piece of obvious advice applies:

· to your significant other

· to your family

· to your business partners

· to your chosen successor

· to your key employees

· to the rest of your employees

· to your 3rd party advisors

· to your clients and suppliers

Create plans that cover your needs and aspirations.

Create plans that cover the needs and aspirations of the people who will contribute to your business success.

View all of this work as an investment in your business and your personal success.

|

|