Yes – there are many other reasons why you are driven to be in business. Regardless, you are in business to generate money. You have set a plan for your business and those plans include the generation of money to cover costs, which will include your personal remuneration.

When all of the costs are covered there will be profit…you have planned for gross profit. Linked to that profit, you likely have planned to make bonus payments to employees, including yourself and to other owner-operators, if any. After those payments are made, the remaining profit can either be left in your business as retained earnings or it can be paid out as dividends to owners.

There are lots of choices in business.

And, business is about generating profits and personal wealth.

Don't be shy about that.

Profit is a valuable thing in business.

Be clear about that.

Talk about profit.

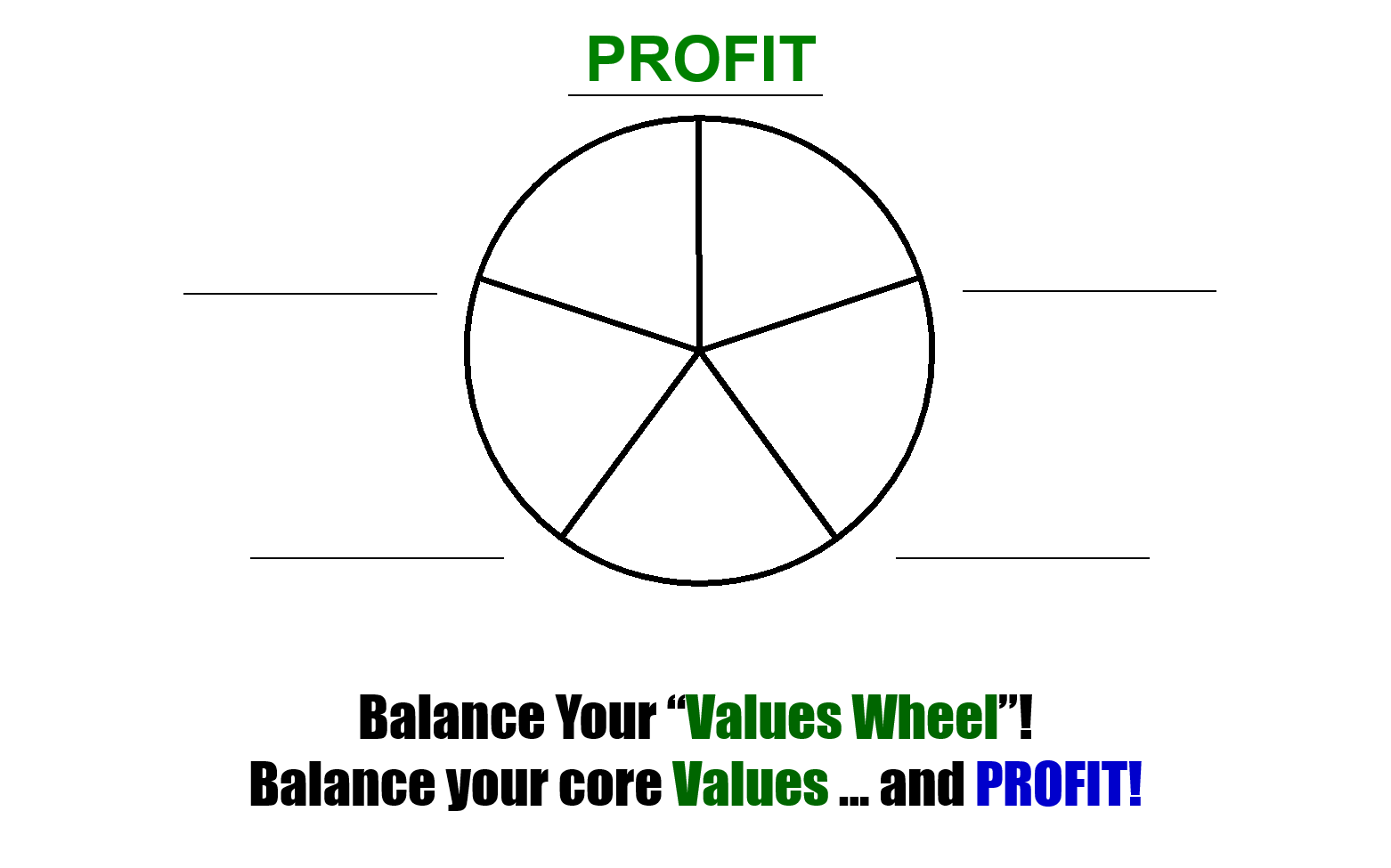

Talk about profit and its relationship with your other corporate Values.

Use visual tools to clarify the picture as you see it.

For example...

In summary, you have 3 ways to receive money from your business:

- Salary [wages],

- Bonus, and

- Dividends.

Many might view the following question as rhetorical.

Nonetheless, we will ask it:

Why would you want to receive money from your business?

The answer is: (1) to cover your current needs for money and (2) to cover your future needs for money.

Few small-business owners will argue with both those reasons.

Fewer small-business owners will do both of them.

Most small-business owners are challenged to succeed at the first one. In fact, succeeding at the first one consumes so much time and energy, most small-business owners never get around to working on the second one.

Why?

Because most small-business owners fail to plan. When they fail to business plan they pave the path for failing to succession plan. Time spent planning and particularly time spent succession planning keeps the end-point vision front and centre in the business owner’s mind. That vision is linked to longer-term goals. So, longer-term goals are also front and centre in the business owner’s mind. When the end-point vision and long-term goals are front and centre, actions have guiding lights to follow. With guiding lights in place, the likelihood of success increases.

This is another key reason you should create a succession plan.

Separate yourself from the pack.

About the pack: Most small-business owners will be acutely aware of the need for current transfers of money from their business bank to their personal bank. They are acutely aware of the need because they know they need personal money to buy food, pay for a place to live, pay for a car…and pay for a long list of other things. Most small-business owners will expend a great deal of energy figuring out how to make these money transfers to cover their immediate, personal-money needs.

Yet, most small-business owners will expend little or no energy figuring out how to make money transfers to cover future needs. As a result, most small-business owners are ill-prepared to cover personal-emergency cash needs and even more fail to prepare for their retirement-money needs.

Increasing the likelihood of business success…that is one of the main reasons a business owner must perform succession planning. As Napoleon Hill taught in his 1937 classic ‘Think And Grow Rich’ –

“Plan Your Work and Work Your Plan.”